Executive Summary

* Expectations of a strong economic rebound, combined with a sharp rise in energy prices have led to a continuous rise in inflation expectations.

* With pension promises linked to inflation, inflation hedging is an important factor for trustees to consider.

* Liability benchmarks used as a reference when constructing liability hedge portfolios are dependent on the assumptions used during calibration and consideration is required to ensure these remain appropriate.

10yr/10yr Inflation Expectations (%)

Source: Barclays as at December 2021

Background

The DB pension scheme landscape is changing. The vast majority of schemes are now closed to new entrants and an increasing number are also closing to future accrual. As a result, these legacy DB pension schemes are seeking to reduce the likelihood of reliance on the sponsoring employer over time by reducing investment risk.

Changes in future inflation expectations pose a significant risk to pension schemes

Changes in future inflation expectations pose a significant risk to pension schemes, due to the inflation linkage within pension promises. Supply chain issues linked to Covid-19, growing trade protectionism, and a strong economic rebound, combined with a sharp rise in energy prices have led to significant increases in inflation expectations, and hence increases in the price of index-linked gilts, over the last 12 months.

What is perhaps surprising is the impact, not only on short-dated inflation expectations, but on long-dated inflation expectations too.

In November 2020, the Chancellor announced the change of the inflation measure from RPI to CPIH, to take effect in 2030. For pension schemes with benefits linked to RPI, this change will result in a fall in liability valuations with future pension payments rising at a lower rate than previously expected.

The unusual degree of uncertainty regarding the inflation outlook and recent RPI Reform provides a good reason for trustees to review their inflation exposure and hedging arrangements.

Liability Hedge Benchmarks

The benefit structure of a DB pension scheme can be very complex, with different benefits before and after retirement. The majority of pension scheme benefits are linked to inflation in some way, with some having fixed increases, full inflation increases or increases with caps and floors applied.

Many of these liabilities can’t be hedged precisely due to the limited inflation-linked instruments available in the market. Therefore a benchmark of nominal and real cashflows, the “liability benchmark”, is typically used as a reference for constructing an LDI solution and monitoring the position over time.

The problem however is that this liability benchmark is heavily dependent on the assumptions used. In particular, the level of future inflation expectations and the 'RPI-CPI Wedge' which should be revised in light of the RPI Reform.

Simplifying the liabilities in this way means that the benchmark will not perform in line with the scheme’s underlying liabilities in all scenarios. We encourage trustees to consider stress testing the liability benchmark to provide an indication of when to recalibrate. This will help ensure that hedging in place remains, in line with trustee objectives over time.

Case Study

Calculating a liability benchmark and maintaining accuracy relative to the underlying liabilities

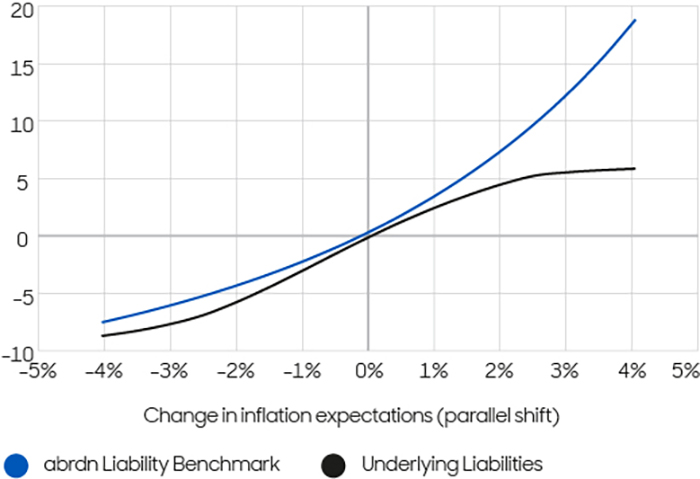

To represent the current inflation exposure as accurately as possible, a +/- 1bp shift in inflation is used to calculate the liability benchmark. However, to assess the suitability of the benchmark under different inflation expectations and when it could be recalibrated over time, we analyse the performance of this benchmark (Present Value, PV) relative to the underlying liabilities in a range of interest rate and inflation scenarios.

Liability benchmark

Source: abrdn

In our above example, the liability benchmark outperforms the liabilities in both rising and falling inflation scenarios. With inflation caps and floors in the underlying benefits, this could indicate that some of the caps embedded in the liabilities are already in-the-money. However, once inflation has shifted up or down, if the benchmark (and hedging solution) is not recalibrated, underperformance could follow if inflation reverses (i.e. this represents a potential opportunity to lock in gains).

Our analysis, as illustrated in the following two charts, suggests that suitable recalibration points could be at around a -1.5% and +1.0% change in long-term inflation expectations.

Change in PV

Chart sources: abrdn

This analysis can then be used to set trigger levels where the liability benchmark would be recalibrated if inflation triggers were breached. The impact can be very significant. We investigated the impact using data from an actual scheme. We looked at what the impact would be if inflation expectations rose by at least 1.25% p.a., we changed the liability benchmark to be appropriate for the higher-inflation environment at +1.25%, and then inflation fell back down to the starting position. Switching to the revised liability benchmark after a 1.25% rise in inflation would save this particular scheme 5.9% of the value of its liabilities should inflation subsequently fall back down to the starting point, representing a 5.9 percentage point improvement in the funding level.1

Conclusion

The volatility in the inflation outlook and outcome of the RPI Reform consultation pose a challenge to pension trustees. While many schemes already have strategies in place to hedge inflation risk, careful consideration is required to ensure this remains appropriate.

The accuracy of a liability hedging strategy is dependent on the assumptions made when calibrating the liability benchmark used to design the solution. As such, this benchmark should be refreshed when market conditions change significantly, in addition to triennial updates following an actuarial valuation.

Pension solutions teams can work with trustees and their advisors to help create a suitable liability benchmark using cashflow projections under different inflation assumptions. Once the liability benchmark is constructed, pension solutions teams can also help design a tailored hedging solution to meet the long-term objectives of the scheme.

Additional Reading

Implementation Considerations: Hedging the liability benchmark

Once the liability benchmark is constructed, it is important to review the hedging objectives and approach to implementation.

Hedge Targets

Once a decision is made to hedge inflation risk, the detail of this needs to be considered to ensure any remaining funding level volatility is within trustees risk tolerance.

1. What proportion of liabilities should be hedged?

2. Should the hedge based on the total liabilities, or funded liabilities?

3. What liability basis should be hedged: Technical Provisions (TP), low risk or buyout?

When targeting hedge ratios on a low risk liability basis it may result in over-hedging on a TP basis.

This can add additional funding level volatility which may impact the level of sponsor contributions required in the future.

Operational Considerations

Every client’s requirements are different and these requirements will change over time as their hedging strategy evolves and their funding levels improve. The two main approaches to implementation are as follows:

*Pooled solution: A pooled fund solution is a low governance approach allowing pension schemes of all sizes to have access to efficient hedging strategies. With the right range of pooled funds, it is possible to tailor the solution to meet schemes’ individual requirements.

*Segregated solution: Under this approach clients will benefit from bespoke, tailored solutions to meet their specific requirements (e.g. hybrid discount curves etc). This bespoke nature increases the governance requirements on trustees.

- Our assumption is that an accurate hedge is in place that tracks the value of the liability benchmark in place, so we used the change in value of the liability benchmark.